As a homebuilder, we hear the “one-and-done” sentiment all the time. Many homebuyers want to “get it right” the first time they purchase a home so they can be settled for the long haul. Why not save and keep renting until you can afford exactly what you want? While a no-compromise stance sounds good in theory, it may actually be a roadblock to your dream home. You may find better results by viewing your first home as a stepping stone, not the end goal. Making your first home part of a long-term strategy may even help you get to your ultimate goal quicker!

The chance to leverage equity

Though there are no guarantees that your home will rise in value, you may be able to leverage home equity as a means to save up for your dream home without having to scrimp and pinch pennies every month.

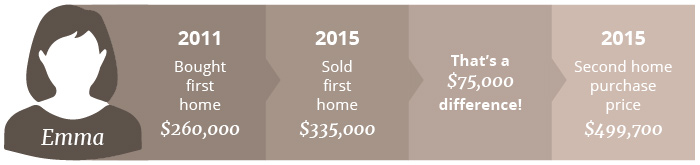

Look at these two real-life examples:

Thanks to appreciation, buying a home allowed Emma and her family to build $75,000 in equity, minus any commissions and fees from selling the home. While it’s possible they could have saved a similar amount while renting, they would have had to set that money aside out of their income in addition to housing costs. Instead, they put their monthly mortgage payment to work for them with great results!*

Jason’s family is considering a move in the next couple years. If they are able to sell their home for Zillow’s estimate, they will have a substantial amount to put down on their next home. While there are no givens in real estate, living in a purchased home rather than a rented one has the potential to pay off. In the case of Jason, around $176,000 in equity could put them closer to their dream home.*

The cost of rent vs. a mortgage

The potential to earn equity isn’t the only factor to take into account when considering purchasing a “stepping stone” home. It is important to consider the cost of continuing to rent and compare it to an estimated monthly payment on a purchased property. Even in markets where the monthly rent is comparable or slightly higher than rent, a fixed-rate mortgage would keep you from living at the mercy of potential rent hikes.

Consider the following monthly payment scenarios, based on the September 2019 average rental rate listed on Zumper.com and the monthly payment on popular 2- to 3-bedroom Seasons™ floor plans in the same market.

Important note! All Richmond American payment examples below are based on a 30-year fixed-rate FHA mortgage financed through HomeAmerican Mortgage Corporation, based on an estimate from 9/25/19.

| Real estate market | Average 2-bedroom rent/mo. | Estimated monthly payment on a Richmond American plan (as of 9/25/19)** Click links below for additional financing information. |

|---|---|---|

| Orlando, FL | $1,460 | $890 (Haines City) |

| Salt Lake City, UT | $1,440 | $1,220 (Stansbury Park) |

| Seattle, WA | $2,410 | $1,650 (Buckley) |

| Washington, D.C. | $2,910 | $1,170 (Ruther Glen) |

To see how the rental market can fluctuate, review rental rates for September 2019.

Buying a home for the first time is an exciting milestone. It’s only natural that you would want the experience to be perfect. However, managing your expectations as a homebuyer and making smart choices may put you in your dream home faster! Everyone’s financial situation is different. We always recommend speaking with a loan officer to strategize your long-term homeownership plans.

If you want to learn more, contact our affiliates at HomeAmerican Mortgage Corporation today: 866.400.7126

*Information provided above is not intended to replace advice from a licensed financial advisor. Real estate values can fluctuate with the market and appreciation on a Richmond American home is not guaranteed.

**In the Seasons Collection payment examples, taxes, monthly mortgage insurance premiums, and hazard insurance are estimates only and actual payment may be higher. Prices shown may not include charges for options, upgrades and/or lot premiums. Information concerning the pricing and availability of our homes, are subject to change without notice. Financing is provided by HomeAmerican Mortgage Corporation (NMLS Unique Identifier #130676; NMLS Consumer Access Website: http://www.nmlsconsumeraccess.org), 866-400-7126. HomeAmerican Mortgage Corporation’s principal offices are located at 4350 S. Monaco Street, Suite 200, Denver, CO 80237. Arizona Mortgage Banker License #0009265. Estimated monthly payment is based on a 30-year FHA fixed-rate loan with an interest rate of 3.500% and a 3.5% down payment, which was available as of September 25, 2019. APR varies by region between 4.539% and 4.577%. See floor plan page for details on each payment example. Interest rate is not guaranteed and is subject to change without notice. Please click the links in the table above for current interest rates and payments, as well as full disclosures pertaining to each payment example.