Tag: online resources

-

10 Best Articles to Celebrate a Decade

Read more: 10 Best Articles to Celebrate a DecadeOur blog turns 10 years old today! Thank you for following and reading the stories we’ve shared. We hope you have enjoyed the last decade as much as we have and that you will continue to engage with our content moving forward as we share timely tips and stories about homebuying, home sales, home decorating,…

-

5 Resources for Navigating Mortgage Options

Read more: 5 Resources for Navigating Mortgage OptionsWith so many available mortgage options, it can be confusing to know which path is right for you. The following online resources can help you understand the differences between loan types and answer other questions that may arise when financing your dream home. Fannie Mae® This site has information on everything from estimating mortgage payments…

-

How to Use a Mortgage Calculator

Read more: How to Use a Mortgage CalculatorMortgage calculators are an underappreciated example of how the web has made home shopping easier, smarter and flashier. OK, maybe not flashier, but definitely easier and smarter, as they can provide quick insights into whether you’re able to afford a mortgage, and if so, what you’ll want or need for a down payment, monthly payment,…

-

25 Best Posts for Home Shoppers, Sellers & Lovers!

Read more: 25 Best Posts for Home Shoppers, Sellers & Lovers!We’re celebrating seven years of home-centered stories by rounding up our most popular articles in each category! We hope you’ll enjoy them and keep following our blog for more homebuying tips, recipes, decorating inspiration, local real estate stories and more. Best posts for homebuyers The Facts on Closing Costs Finding a New Home that Fits…

-

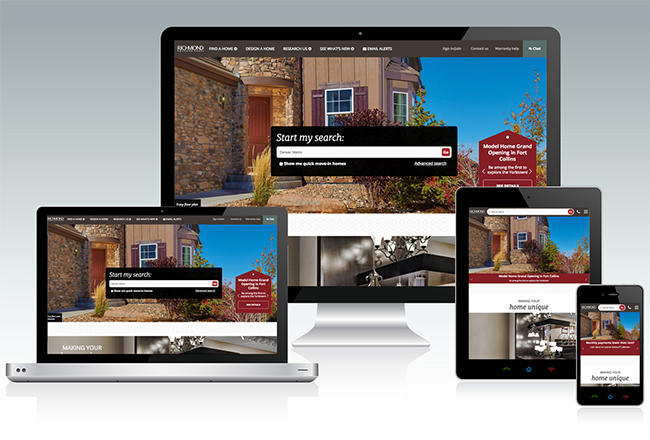

Online Marketing Techniques to Sell Your Home

Read more: Online Marketing Techniques to Sell Your HomeWhen it comes to marketing your home online, your best bet is probably a seller’s agent with the industry tools, skills and know-how to effectively advertise your home on the multiple listing service (MLS). However, once your MLS listing is out in the world, you might find that broadcasting it with some powerful—and freely available—online…

-

Five Years of Fan Favorites

Read more: Five Years of Fan FavoritesThank you for following our blog! Each week, we’re excited to reach our readers, whether you’re a house hunter looking for the perfect place to fit your lifestyle or a homeowner in search of the perfect place setting to fit your taste. To celebrate five fun years, we’ve rounded up our five most popular articles of all time.…