If you’re in the market for a new home, chances are you have a budget in mind. After all, a house is likely one of the largest purchases you’ll make in your lifetime. You want to make sure you only buy what you can afford… but what if you can actually afford more than you think?

Enter: Special financing and the power of the rate.

As it so happens, the price of a home only tells part of the affordability story. It’s easy to see a six-, seven-, or even eight-figure price tag and instantly assume that a house is out of reach… Would you believe us if we said you might be selling yourself short?

With the help of special financing from our affiliates HomeAmerican Mortgage Corporation (HMC; see licensing info) and the empowering rates that accompany it, you could enjoy lower monthly payments on a brand-new home, allowing you to afford a house that you previously deemed out of your price range! Wondering how this is possible? Let us explain…

What is special financing?

To understand the power of the rate, it’s important to first understand we mean by “special financing.” The definition of special financing can depend on the industry, but in our case—and the case of HMC—special financing refers to limited-time rates and offers that can help you save thousands on a new home. Unlike resale homes, Richmond American properties often come with significantly lower mortgage rates—thanks to our builder-backed incentives. Through HMC, buyers can take advantage of financing options that resale simply can’t match.

Here are some specifics you need to know:

- Special financing generally takes the form of reduced fixed or adjustable interest rates for 30-year FHA, Conventional, or VA loans. Other loan options may be available at different rates and terms.

- Be sure to pay attention to offer requirements, such as contract-by and closing dates.

- Funding for these special rates may be limited and could run out before an offer’s end date. With this in mind, it’s important to act fast if you want to take advantage of special financing, because it’s typically available on a first-come, first-served basis.

- Don’t assume that special financing will always be available. Though there are many other advantages to using our affiliated lender, special financing should not be considered a standard offering.

- Offers will vary depending on your region. Visit our website to see what’s available in your area.

But what does that actually look like in practice?

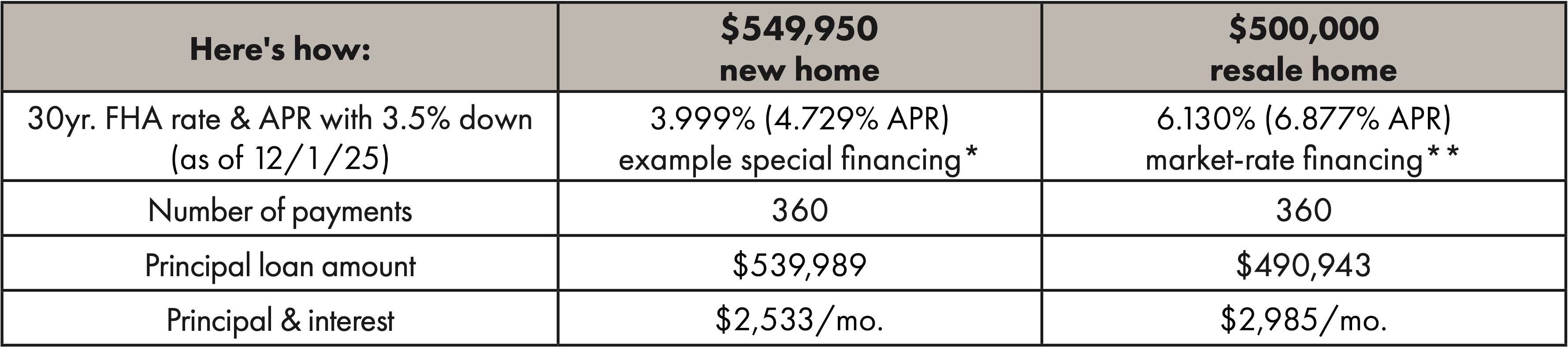

The information above may feel a bit broad, so let’s take a look at some specific numbers that may help with you better understand special financing. Here’s an example of how special financing could help you afford a higher-cost home at a lower monthly rate, as compared to market-rate financing:

Taxes, hazard insurance and monthly mortgage insurance premiums are not calculated in the above payments. Actual payments will be higher. Example pricing is provided by HomeAmerican Mortgage Corporation (see licensing info).

It’s important to remember that the numbers above represent an example of how special financing rates could impact your loan payments. Exact pricing and calculations will vary depending on your region, community, home, lender, and current offers. Be sure to speak with your loan officer for more accurate information!

What do I need to know about HMC?

HomeAmerican Mortgage Corporation, or HMC for short, is Richmond American’s affiliate lender. As a full-service lender, HMC offers a variety of loan options without the use of brokers as middlemen. Its team of licensed mortgage professionals provides dedicated and personalized care throughout the process, ensuring that you feel confident and well-informed as you secure financing for your dream home.

HMC’s loan officers are also well-versed in the Richmond American homebuying process, allowing them to offer a streamlined, comprehensive experience for the RAH buyers who choose to utilize them.

Final notes

Buying a home is no small decision, and it’s crucial to choose one that fits both your budgetary and lifestyle needs. Our homes are designed with style and livability in mind, but it’s equally as important for us to offer listings that are priced within reach. Special financing offers from HMC help us do just that. The RAH / HMC affiliation is an important one. Because of RAH’s powerful support, HMC’s offerings are much lower than what you’re going to see in the general marketplace, especially the resale market.

Empowering rates could completely change your house hunt. Ready to see how?

Call 866.400.7126 or visit HomeAmericanMortgage.com to speak with a loan officer.

Be the first to hear about special offers!

Stay up to date on new neighborhoods and floor plans, special offers and more. Sign up for local email alerts.

*Loan promotion example is provided by HomeAmerican Mortgage Corporation (see licensing information below) and is intended for illustrative purposes only. Interest rate is not guaranteed and is subject to change without notice. Funds are limited and are available on a first-come, first-served basis. The rate above is based on the application of seller-paid closing cost assistance in the amount of 2% of the loan amount applied to obtain a permanent interest rate buydown. Actual amount of closing cost assistance cannot exceed buyer’s actual closing costs. This offer can be used with other national or community-level incentives, but the total promotion amounts provided for using HomeAmerican Mortgage Corporation are subject to legal and loan program requirements and limitations. Example is based on a sales price of $549,950 and a 30-year, fixed-rate FHA loan with an interest rate of 3.999% and a 3.50% down payment. Total loan amount, including the upfront mortgage insurance premium, is $539,989. Monthly principal and interest payment = $2,533.00. APR = 4.729%. Taxes, hazard insurance and monthly mortgage insurance premiums are not calculated in the above payment; actual payment will be higher. This interest rate is available to owner occupants only and is subject to availability, a debt-to-income ratio of 43% or less, a maximum 96.5% loan-to-value ratio, qualification using full documentation and a minimum FICO score of 680. Other loan-to-value ratios and FICO scores may be eligible but may be subject to rate and price adjustments. Loan amount cannot exceed the lesser of the county limit or $806,500. Not valid on loans already locked with HomeAmerican Mortgage Corporation.

**The average interest rate available for a 30-year fixed rate FHA mortgage on 12/1/2025 is 6.130% according to the latest Bankrate.com survey of large U.S. lenders https://www.bankrate.com/mortgages/fha-loan-rates. Estimated APR and monthly payments are provided by HomeAmerican Mortgage Corporation (see licensing information below) and are intended for illustrative purposes only. Interest rate is not guaranteed and is subject to change without notice. Example is based on a sales price of $500,000 and a 30-year, fixed-rate FHA loan with an interest rate of 6.130% and a 3.50% down payment. Total loan amount, including the upfront mortgage insurance premium, is $490,943. Monthly principal and interest payment = $2,984.61. APR = 6.877%. Taxes, hazard insurance and monthly mortgage insurance premiums are not calculated in the above payment; actual payment will be higher. This interest rate is available to owner occupants only and is subject to availability, a debt-to-income ratio of 43% or less, a maximum 96.5% loan-to-value ratio, qualification using full documentation and a minimum FICO score of 680. Other loan-to-value ratios and FICO scores may be eligible but may be subject to rate and price adjustments. Loan amount cannot exceed the lesser of the county limit or $806,500. Not valid on loans already locked with HomeAmerican Mortgage Corporation.

HomeAmerican Mortgage Corporation’s offices are located at 4350 S. Monaco Street, Suite 100, Denver, CO 80237 (NMLS Unique Identifier #130676; NMLS Consumer Access website: http://www.nmlsconsumeraccess.org), 866.400.7126.

The Richmond American Homes companies (RAH) and HomeAmerican Mortgage Corporation (HMC) are owned, directly or indirectly, by Sekisui House U.S., Inc. and, therefore, are affiliated companies. RAH and HMC offer services independently of each other, and if you obtain a product or service from one company, you are not required to utilize the services of, or obtain products from, the other company. Your decision to use a company that is not affiliated with RAH or HMC will not affect your ability to obtain products and services from these companies.