It’s 2017, and that means many Americans who were hardest hit by the Great Recession have had time to reestablish their credit and may be thinking about owning a home again. These boomerang buyers—former homeowners looking to reenter the market after having been sidelined by foreclosure or bankruptcy—can be a great demographic for expanding your client base. Oftentimes credit-impacted buyers feel adrift navigating their way back to homeownership, and an agent with the right expertise can prove invaluable. To position yourself for success, check out these beginning pointers on becoming an effective ally for boomerang buyers.

Find their best loan option

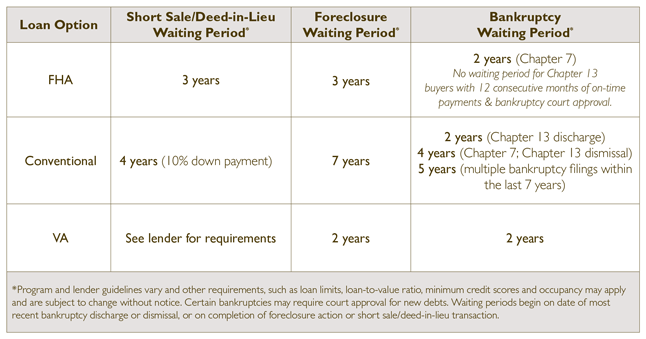

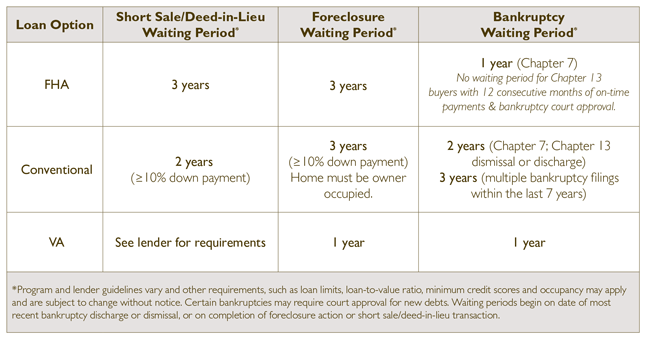

Each loan type has a different waiting period before boomerang buyers can apply for a home loan—and the waiting period can also differ based on what type of credit event occurred. Reference the following tables (from our homebuyer guide) to get an idea of which loan might best fit your client’s situation.

Typical waiting periods

Waiting periods with extenuating circumstances

(For buyers who suffered financial troubles caused by events beyond their control—e.g., major illness, divorce or death of a spouse)

Help them with prequalification

Prequalification for a boomerang buyer won’t be the same as the last time they bought a home. In addition to standard documentation, they’ll need to know what materials to gather related to their foreclosure, short sale or bankruptcy, which may include:

- Bankruptcy records, discharge receipts and/or repayment statements

- A HUD-1 Settlement Statement (received after a short sale), plus a statement from their previous lender indicating their mortgage is considered paid in full

- A Trustee’s Deed or similar document verifying when their foreclosure was complete

Get more information

For more on how to help boomerang buyers get back into the housing market, check out our guide: Buying a House After Bankruptcy, Foreclosure or Short Sale.

And you can always contact our affiliate, HomeAmerican Mortgage Corporation, to have a loan officer help sort through the particulars of the process. Call 866.400.7126 today.